We are reliable & consistent Medical Billing-Solution team

- Mon - Sat 9.00 - 18.00

- (619)493-3926

Overview of Early Outcomes under No Surprises Act Arbitration Process - ebproviders.com

Overview of Early Outcomes under No Surprises Act Arbitration Process

Background

The No Surprises Act (NSA), enacted in 2022, aims to protect patients from unexpected medical bills, particularly for out-of-network services. It establishes independent dispute resolution (IDR) process to resolve payment disputes between insurers and healthcare providers. This process is intended to ensure fair payment rates and minimize patient financial burden.

Data Overview

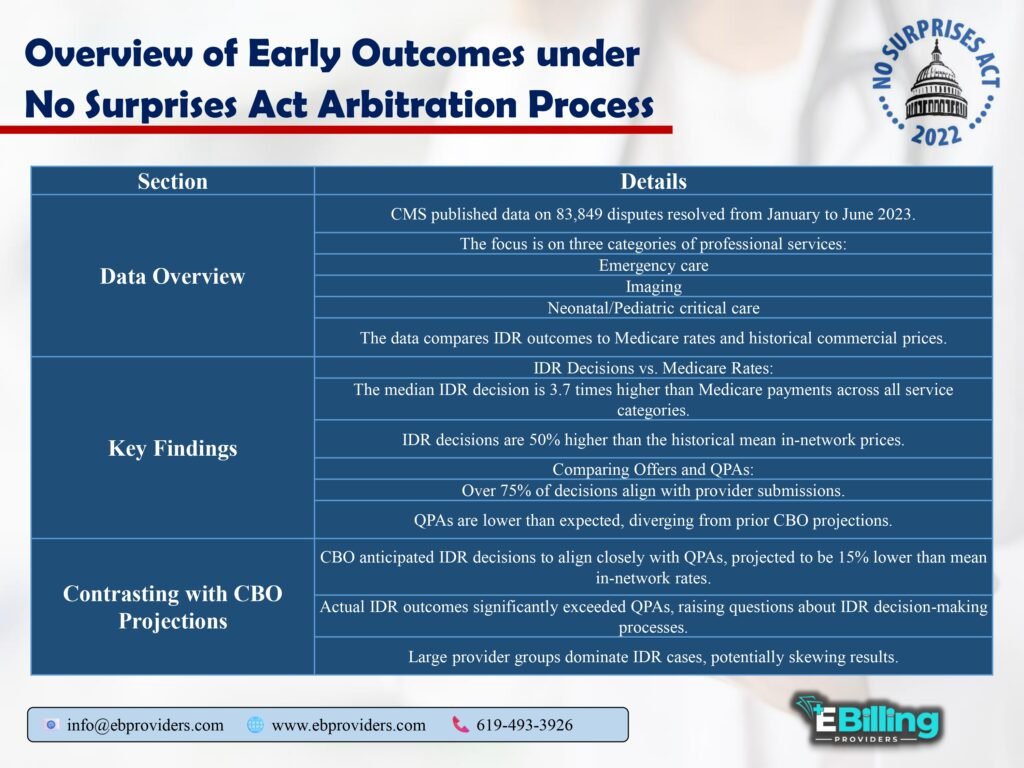

From January to June 2023, Centers for Medicare and Medicaid Services (CMS) published data on 83,849 disputes resolved through IDR process. This analysis focuses on three service categories: emergency care, imaging and neonatal/pediatric critical care. It compares IDR outcomes with Medicare rates and historical commercial prices.

Key Findings

- IDR Decisions vs. Medicare Rates

IDR decisions have yielded significantly higher payment amounts than Medicare rates across all examined service categories. findings are summarized in Table 1.

Table 1: Comparison of IDR Decisions to Medicare Rates

| Service Category | Median IDR Decision | Medicare Payment | IDR vs. Medicare Ratio |

| Emergency Care | $1,200 | $325 | 3.7x |

| Imaging | $1,500 | $400 | 3.75x |

| Neonatal/Pediatric Critical Care | $2,000 | $500 | 4.0x |

- Offers and Qualifying Payment Amounts (QPAs)

The process has seen providers submitting higher offers that IDR entities are favoring. Over 75% of IDR decisions align with provider submissions. QPAs, which are meant to reflect typical market rates, have been found to be significantly lower than historical in-network prices, raising questions about decision-making processes of IDR entities. - Comparison to CBO Projections

The Congressional Budget Office (CBO) projected that IDR decisions would closely align with QPAs, which were estimated to be about 15% lower than mean in-network rates. However, actual IDR outcomes have far exceeded QPAs, suggesting divergence that contradicts initial expectations.

Table 2: IDR Outcomes vs. CBO Projections

| Metric | CBO Projection | Actual IDR Outcome | Deviation from Projection |

| Expected QPA vs. Mean In-Network | 15% lower | Significantly lower | Higher than expected |

| IDR Decisions favoring Providers | Not specified | 75%+ | Exceeds CBO expectations |

- Implications for Overall Prices and Premiums

The implications of current IDR outcomes on future healthcare pricing and insurance premiums remain uncertain and are influenced by several factors:- Representation of Outcomes: IDR outcomes analyzed may not represent typical experiences for smaller providers, who may have different motivations for engaging in IDR.

- Behavioral Changes: Both insurers and providers are likely to adjust their strategies based on observed IDR win rates. Insurers may increase their offers, while providers may escalate their expectations, leading to potential inflation in service costs.

- Negotiation Impact: pricing established through IDR may influence future negotiations for in-network services. If IDR outcomes lead to higher prices, this could create upward pressure on in-network rates, contradicting NSA’s objective to keep costs down.

- Future Directions

Given high win rates for providers in IDR, it is plausible that in-network prices will rise, challenging CBO’s prediction of convergence to QPAs. Lawmakers’ goals of eliminating surprise billing without increasing premiums may be in jeopardy.

Conclusion

The early outcomes of NSA’s IDR process raise important questions about impact on healthcare pricing and patient billing practices. While act aims to protect patients from unexpected costs, it appears that it may inadvertently lead to increased costs for in-network services. These developments underscore need for ongoing assessment and potential adjustments to IDR process to align with NSA’s original objectives.

Methodological Considerations

- Out-of-Scope Line Items: analysis carefully excludes line items related to facility services, ensuring that focus remains on professional services. Exclusions were based on estimated prevalence in dataset.

- Medicare Rates Assignment: Medicare rates were derived from Physician Fee Schedule, with adjustments for regional variations and sequestration.

Leave A Comment