Understanding Good Faith Estimates Under Consolidated Appropriations Act, 2021 - ebproviders.com

Introduction

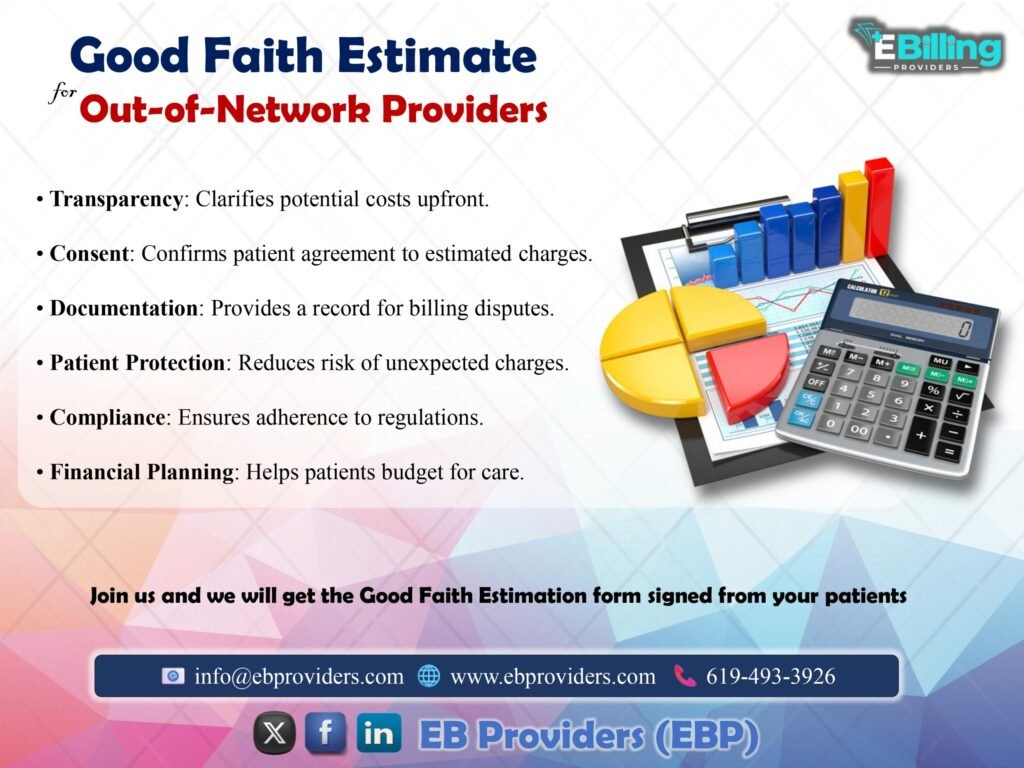

The healthcare landscape is undergoing significant changes, particularly with implementation of Consolidated Appropriations Act, 2021 (CAA 2021), which includes No Surprises Act (NSA). One of pivotal elements of this legislation is introduction of Good Faith Estimates (GFEs) for uninsured or self-pay individuals. These estimates aim to enhance transparency in healthcare pricing, enabling patients to make informed financial decisions regarding their care. This article delves into GFE requirements, their implications for healthcare providers and patients and what individuals need to know.

What is Good Faith Estimate?

A Good Faith Estimate is written document that outlines expected charges for healthcare services. It serves as tool for uninsured or self-pay individuals to understand their potential financial obligations before undergoing treatment. requirement to provide GFEs is designed to mitigate surprise medical bills and foster more transparent healthcare environment.

Effective from January 1, 2022, providers and facilities must furnish GFEs when services are scheduled or upon request. This initiative marks significant shift towards ensuring patients are aware of their financial responsibilities before receiving care.

Who Must Provide GFEs?

All healthcare providers and facilities are mandated to provide GFEs to uninsured or self-pay individuals. This includes hospitals, outpatient clinics and specialized practitioners, creating broad network of accountability. regulations do not exempt any specific specialties or facility types, which ensures that all patients seeking care have access to transparent pricing information.

Key Definitions

- Health Care Provider: This term refers to licensed physicians and other healthcare professionals operating within their legal scope of practice.

- Health Care Facility: This includes institutions such as hospitals, outpatient departments and imaging centers that are licensed under applicable state laws.

When Are GFEs Required?

GFEs must be issued in two key scenarios:

- When uninsured or self-pay individual schedules items or services.

- When such individuals request GFE.

It is essential to note that GFEs are typically not required for emergency services unless those services are scheduled at least three days in advance. This distinction ensures that patients receive necessary information without delaying urgent care.

Multiple Providers: Role of Convening Providers

In cases where multiple providers are involved in patient’s care, “convening provider” or facility has responsibility of issuing GFE. convening provider must include expected charges for services provided by any co-providers or co-facilities involved in treatment.

If GFE does not include charges from co-providers or co-facilities during initial implementation period (January 1, 2022, to December 31, 2022), HHS has indicated that it will exercise enforcement discretion. This gives providers grace period to establish systems for compliance.

Requirements for Providing GFEs

GFEs must adhere to specific guidelines:

- Written Format: estimate should be provided in writing, either on paper or electronically, depending on individual’s preference.

- Clarity and Understandability: GFEs must be written in clear language that can be easily understood by average individual. This requirement is crucial for ensuring that patients can fully comprehend their financial responsibilities.

- Accessibility: Providers must deliver GFE in format requested by individual. For those without internet access or permanent address, GFEs can be provided in person or mailed to specified location.

Financial Assistance Considerations

Healthcare providers must account for any expected financial assistance or discounts when preparing GFE. For instance, tax-exempt hospitals are obligated to consider their Financial Assistance Policies (FAP) when estimating charges. This ensures that GFE accurately reflects patient’s potential financial responsibility and aids in reducing barriers to care.

Dispute Resolution Process

A critical aspect of GFE process is its role in Patient-Provider Dispute Resolution (PPDR) framework. If actual billed charges exceed GFE by at least $400, uninsured or self-pay individual can initiate dispute resolution process. GFE serves as crucial document in this process, allowing patients to contest unexpected costs effectively.

At The End

The implementation of Good Faith Estimates under Consolidated Appropriations Act, 2021, marks transformative step toward improving transparency in healthcare costs for uninsured and self-pay individuals. By understanding these requirements, patients can better navigate their healthcare options and anticipate potential expenses.

As healthcare providers adjust to these regulations, emphasis on clear communication and transparency will empower consumers in their healthcare decisions, fostering more equitable system. For additional details and resources, individuals can visit CMS Good Faith Estimates resource page. This initiative represents significant advancement in patient rights and healthcare accessibility, ensuring that individuals are informed and prepared for their healthcare journeys.

Leave A Comment